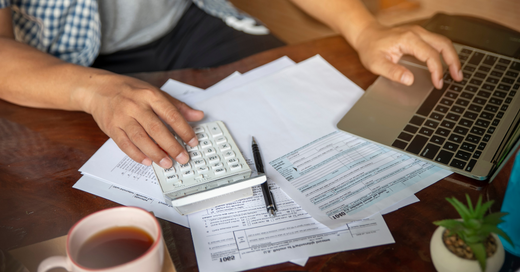

Buying a property is a significant investment for individuals in High Wycombe, but it’s crucial to understand the tax implications associated with property purchases to ensure compliance with HMRC regulations and optimize financial planning. In this article, we’ll explore the tax implications of buying a property in High Wycombe and key considerations for property buyers.

Stamp Duty Land Tax (SDLT)

One of the primary tax implications of buying a property in High Wycombe is the payment of Stamp Duty Land Tax (SDLT) on the purchase price. SDLT is payable on properties above a certain threshold and is calculated based on the property’s value. Different SDLT rates apply to residential and non-residential properties, with additional rates for second homes and buy-to-let properties.

First-Time Buyer Relief

Reliable Tax Accountants in High Wycombe in High Wycombe may be eligible for Stamp Duty Land Tax (SDLT) relief, which allows them to claim a discount or exemption on SDLT for properties below a certain value. This relief can help first-time buyers reduce the upfront costs of purchasing their first property and make homeownership more accessible.

Additional Dwelling Supplement (ADS)

Buyers purchasing additional residential properties, such as second homes or buy-to-let properties, in High Wycombe may be liable to pay an Additional Dwelling Supplement (ADS) on top of the standard SDLT rates. ADS is payable at a higher rate and is designed to discourage the purchase of additional properties and support first-time buyers.

Capital Gains Tax (CGT)

Property buyers in High Wycombe may incur Capital Gains Tax (CGT) liabilities when selling the property in the future if its value increases. CGT is applicable on the difference between the sale proceeds and the acquisition cost of the property, adjusted for allowable deductions and expenses. Principal private residence relief may be available to exempt or reduce CGT liabilities for homeowners.

Council Tax

Property owners in High Wycombe are liable to pay Council Tax on their residential properties, which is a local tax based on the value of the property and the number of occupants. Council Tax rates and bands vary depending on the property’s location and valuation band, and property owners must ensure timely payment of Council Tax to the local authority.

How Council Tax is Calculated

The council tax you pay depends on your property’s band and the rates set by the Wycombe District Council. Discounts and exemptions are available for certain situations, such as single occupancy or low-income households. If you sell your property for more than you paid, the profit may be subject to Capital Gains Tax (CGT).

When CGT Applies to Property Sales

CGT generally applies to second homes and investment properties. Your primary residence is usually exempt, provided it meets specific conditions. Several exemptions and reliefs can reduce your CGT liability, such as Private Residence Relief and Letting Relief for properties that have been rented out. Inheritance Tax (IHT) is levied on the estate of a deceased person, which can include property.

IHT on Inherited Properties

The IHT threshold is currently £325,000. Anything above this amount may be taxed at 40%. However, if the property is passed to direct descendants, an additional residence nil-rate band can increase the threshold. Effective IHT planning, such as making use of allowances and gifting strategies, can significantly reduce the tax burden on your heirs.

Value Added Tax (VAT)

VAT typically does not apply to residential property sales, but it can be relevant in certain situations. VAT is applicable on commercial property transactions and new builds. It’s crucial to check the specific VAT implications with your solicitor. Some property transactions may qualify for reduced VAT rates or exemptions, such as those involving certain renovations or charitable uses.

Income Tax Considerations

For those planning to rent out their property, understanding income tax on rental income is essential. Rental income is subject to income tax. The rates are the same as those for other types of income, depending on your overall earnings. Landlords can deduct expenses related to property maintenance, mortgage interest (subject to restrictions), and certain professional fees from their rental income.

Tax Reliefs for Landlords

Various reliefs, such as the Rent-a-Room Scheme and Wear and Tear Allowance (for furnished properties), can help reduce taxable income. Non-resident property buyers have specific tax obligations and considerations. Non-residents must pay SDLT and may also be subject to UK income tax on rental income and CGT on property sales.

Double Taxation Agreements

The UK has agreements with many countries to prevent double taxation. These agreements can influence how much tax you owe. Non-residents need to file UK tax returns if they receive rental income or sell a UK property. It’s advisable to consult a tax professional for guidance. Effective tax planning can save you significant amounts of money and reduce stress.

Importance of Tax Planning

Being proactive about tax planning helps you take advantage of available reliefs and avoid penalties. Make sure to claim all eligible reliefs and exemptions to minimize your tax liability. Consider long-term strategies, such as trust planning and investment in tax-efficient schemes, to manage your tax burden over time. Navigating property taxes can be complex, and professional advice is invaluable.

Role of Solicitors and Tax Advisors

Solicitors and tax advisors can provide tailored advice, ensure compliance, and help you optimize your tax position. Look for professionals with experience in property taxation and good client reviews. Personal recommendations can also be helpful. While hiring professionals involves costs, the potential savings and peace of mind often outweigh these expenses.

Common Mistakes to Avoid

Avoiding common pitfalls can save you from costly errors.

Overlooking SDLT Obligations

Always check the latest SDLT rates and rules, especially if you’re a first-time buyer or buying an additional property. Ensure you understand your council tax band and explore any applicable discounts or exemptions. Plan ahead for potential CGT liabilities, especially if you own multiple properties.

Overview of Recent Tax Changes Affecting Property Buyers

Recent changes, such as adjustments to SDLT thresholds or new reliefs, can impact your tax obligations. Understanding these changes helps you make informed decisions and anticipate market trends. Keep an eye on proposed legislation that could affect property taxes, such as changes in CGT or inheritance tax rules. Learning from real-life examples can provide valuable insights.

Example Scenarios of Property Tax Calculations

Consider scenarios like buying a second home or inheriting a property to understand potential tax implications. Real-life cases can highlight common mistakes and effective tax planning strategies.

FAQs

What is the current SDLT rate for first-time buyers?

First-time buyers are exempt from SDLT on the first £425,000 of the property’s value. Beyond that, a 5% rate applies up to £625,000.

How can I appeal my council tax band?

You can appeal your council tax band by contacting the Valuation Office Agency (VOA) if you believe your property is incorrectly banded.

Are there any CGT exemptions for primary residences?

Yes, Private Residence Relief generally exempts your main home from CGT.

What expenses can landlords deduct from rental income?

Landlords can deduct expenses such as property maintenance, mortgage interest (with some restrictions), and professional fees from their rental income.

Do non-residents need to file UK tax returns?

Non-residents must file UK tax returns if they receive rental income or sell a property in the UK. It’s advisable to seek professional advice to navigate these obligations.

Conclusion

In conclusion, buying a property in High Wycombe has various tax implications for property buyers, including Stamp Duty Land Tax (SDLT) on the purchase price, First-Time Buyer Relief for eligible buyers, Additional Dwelling Supplement (ADS) for second homes and buy-to-let properties, potential Capital Gains Tax (CGT) liabilities on future sales, and Council Tax obligations. By understanding these tax implications and seeking professional advice, property buyers can effectively manage their finances, minimize tax liabilities, and ensure compliance with HMRC regulations in High Wycombe.